Page 62 - 香港旅遊業議會(2017-2018年度報告)

P. 62

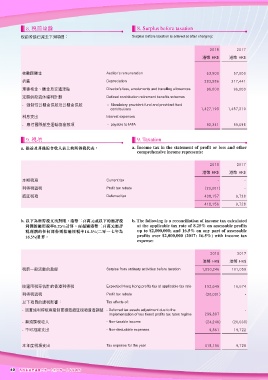

. ۃޮቱ 8. Surplus before taxation

稅前盈餘已減去下列項目: Surplus before taxation is arrived at after charging:

2018 2017

港幣 HK$ 港幣 HK$

核數師酬金 Auditor’s remuneration 63,500 57,000

折舊 Depreciation 283,586 317,441

理事袍金、酬金及交通津貼 Director’s fees, emoluments and travelling allowances 96,000 96,000

定額供款退休福利計劃 Defined contribution retirement benefits schemes

- 強制性公積金供款及公積金供款 - Mandatory provident fund and provident fund

contributions 1,427,193 1,487,310

利息支出 Interest expenses

- 應付國際航空運輸協會款項 - payable to IATA 92,341 55,698

. ධ 9. Taxation

a. 損益及其他綜合收入表上的所得稅代表: a. Income tax in the statement of profit or loss and other

comprehensive income represents:

2018 2017

港幣 HK$ 港幣 HK$

本期稅項 Current tax - -

利得稅退稅 Profit tax rebate (20,001) -

遞延稅項 Deferred tax 438,157 9,728

418,156 9,728

b. 以下為所得稅支出對賬,港幣二百萬元或以下的應評稅 b. The following is a reconciliation of income tax calculated

利潤按適用稅率8.25%計算,而超過港幣二百萬元應評 at the applicable tax rate of 8.25% on assessable profits

稅利潤的任何部份則按適用稅率16.5%(二零一七年為 up to $2,000,000; and 16.5% on any part of assessable

16.5%)計算: profits over $2,000,000 (2017: 16.5%) with income tax

expense:

2018 2017

港幣 HK$ 港幣 HK$

稅前一般活動的盈餘 Surplus from ordinary activities before taxation 1,850,246 101,059

按適用稅率估計的香港利得稅 Expected Hong Kong profits tax at applicable tax rate 152,645 16,674

利得稅退稅 Profit tax rebate (20,001) -

以下項目的課稅影響: Tax effects of:

- 因實施利得稅兩級制而導致遞延稅項資產調整 - Deferred tax assets adjustment due to the -

implementation of two tiered profits tax rates regime 299,897

- 無須課稅收入 - Non-taxable income (24,246) (26,668)

- 不可扣減支出 - Non-deductible expenses 9,861 19,722

本年度稅項支出 Tax expense for the year 418,156 9,728

60

60 香港旅遊業議會二零一七至二零一八年度報告