Page 66 - 香港旅遊業議會(2017-2018年度報告)

P. 66

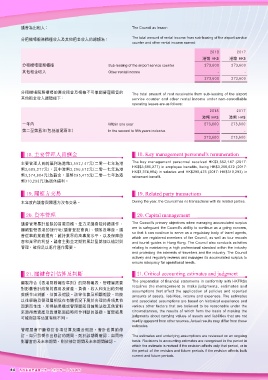

議會為出租人: The Council as lessor:

分租機場服務櫃檯收入及其他租金收入的總額為: The total amount of rental income from sub-leasing of the airport service

counter and other rental income earned:

2018 2017

港幣 HK$ 港幣 HK$

分租機場服務櫃檯 Sub-leasing of the airport service counter 273,600 273,600

其他租金收入 Other rental income - -

273,600 273,600

分租機場服務櫃檯的應收租金及根據不可撤銷營運租賃的 The total amount of rent receivable from sub-leasing of the airport

其他租金收入總額如下: service counter and other rental income under non-cancellable

operating leases are as follows:

2018 2017

港幣 HK$ 港幣 HK$

一年內 Within one year 273,600 273,600

第二至第五年(包括首尾兩年) In the second to fifth years inclusive - -

273,600 273,600

. ˴ࠅ၍ଣɛࡰཇږ . Key management personnel's remuneration

主要管理人員的福利為港幣3,552,147元(二零一七年為港 The key management personnel received HK$3,552,147 (2017:

幣3,685,277元),其中港幣3,256,672元(二零一七年為港 HK$$3,685,277) in employee benefits, being HK$3,256,672 (2017:

HK$3,374,984) in salaries and HK$295,475 (2017: HK$310,293) in

幣3,374,984元)為薪金,港幣295,475元(二零一七年為港 retirement benefit.

幣310,293元)為退休福利。

. ᗫஹ˙ʹ . Related party transactions

本年度內議會與關連方沒有交易。 During the year, the Council has no transactions with its related parties.

. ༟͉၍ଣ . Capital management

議會管理累計盈餘的首要目標,是力求議會能持續運作, The Council’s primary objectives when managing accumulated surplus

繼續監管香港的旅行社(議會登記會員)、領隊及導遊。議 are to safeguard the Council’s ability to continue as a going concern,

so that it can continue to serve as a regulatory body of travel agents,

會從事的業務還有:維持業界的高專業水平,以及保障旅 which are registered members of the Council, as well as tour escorts

客和業界的利益。議會主動並定期對累計盈餘加以檢討與 and tourist guides in Hong Kong. The Council also conducts activities

管理,確保足以應付運作需要。 relating to maintaining a high professional standard within the industry

and protecting the interests of travellers and the industry. The Council

actively and regularly reviews and manages its accumulated surplus to

ensure adequacy for operational needs.

. ᗫᒟึࠇПၑʿкᓙ . Critical accounting estimates and judgment

The preparation of financial statements in conformity with HKFRSs

編製符合《香港財務報告準則》的財務報表,管理層需要 requires the management to make judgments, estimates and

對影響會計政策的應用及資產、負債、收入和支出的列報 assumptions that affect the application of policies and reported

款額作出判斷、估算及假設。該等估算及相關假設,均按 amounts of assets, liabilities, income and expenses. The estimates

以往經驗及管理層相信在有關情況下屬於合理的各項其他 and associated assumptions are based on historical experience and

因素而作出,所得結果構成管理層就目前無法從其他資料 various other factors that are believed to be reasonable under the

來源得悉資產及負債賬面值時所作判斷的基礎。實際結果 circumstances, the results of which form the basis of making the

可能與該等估算有所不同。 judgments about carrying values of assets and liabilities that are not

readily apparent from other sources. Actual results may differ from these

estimates.

管理層會不斷修訂各項估算及隱含假設。會計估算的修

訂,如只影響作出修訂的期間,則於該期間確認;如同時 The estimates and underlying assumptions are reviewed on an ongoing

影響當前及未來期間,則於修訂期間及未來期間確認。 basis. Revisions to accounting estimates are recognised in the period in

which the estimate is revised if the revision affects only that period, or in

the period of the revision and future periods if the revision affects both

64 current and future periods.

64 香港旅遊業議會二零一七至二零一八年度報告