Page 59 - 香港旅遊業議會(2017-2018年度報告)

P. 59

. ৌਕࠬᎈ၍ଣ 4. Financial risk management

金融工具 Financial instruments

The principal financial assets of the Council are annual fee receivable

議會的主要金融資產為會員年費、雜項按金、預付款項、 from members, sundry deposits, prepayments, temporary payments,

暫付款項、銀行結餘、存款及現金。議會的主要金融負債 bank balances, deposits and cash. The principal financial liabilities of the

為預收會員收費、其他應付款項、預收訓練課程費用、預 Council include membership fees received in advance, other payables,

收證件費用、預收印花徵費、普通會員的保證按金、應付 course fees received in advance, pass fees received in advance, levy

賬款及應計支出。在截至二零一八年六月三十日止的年度 received in advance, security deposits received from Affiliate Members,

accounts payable and accruals. The Council did not hold or issue any

內,議會並未持有或發出任何金融工具以作交易用途,亦 financial instruments for trading purposes or any positions in derivative

沒有任何衍生工具合約的持倉。\ contracts during the year ended 30th June, 2018.

a. 外匯風險 a. Foreign currency risk

Substantially all the revenue-generating operations of the Council

整體而言,在截至二零一八年六月三十日止的年度內,議 were transacted in the Hong Kong dollar during the year ended 30th

會所有產生收入的營運均以港幣交易,港幣即為議會的功 June, 2018, which is the functional and presentation currency of

能貨幣及列賬貨幣。議會因此並沒有重大外匯風險。 the Council. The Council therefore does not have significant foreign

exchange risk.

b. 信貸風險 b. Credit risk

信貸風險指交易對手不能於到期時全數繳付款項的風 Credit risk is the risk that a counterparty will be unable to pay

險。議會的「應收款項」性質上十分短期,相關的風險 amounts in full when due. The Council’s “receivables” are very short-

甚低。會費、收費、課程收入、租金收入及其他活動都 term in nature and the associated risk is minimal. Subscriptions,

fees, income from courses, rental income and other activities are

預先收取。截至二零一八年六月三十日止,議會並沒有 collected in advance. As at 30th June, 2018, the Council has no

嚴重集中的信貸風險,而所有應收賬款的結餘既未逾期 significant concentration of credit risk and all balances of accounts

亦未減值,與多個近期沒有拖欠紀錄的不同類型債務人 receivable are neither past due nor impaired and relate to a large

有關。 number of diversified debtors for whom there was no recent history

of default.

c. 利率風險 c. Interest rate risk

利率風險指金融工具的價值因市場利率變動而出現波動 Interest rate risk is the risk that the value of a financial instrument

的風險。議會由於現金及銀行結餘因應市場主要利率水 will fluctuate due to changes in market interest rates. The Council is

平的波動而承受風險。 subject to the risk due to fluctuation in the prevailing levels of market

interest rates on its cash and bank balances.

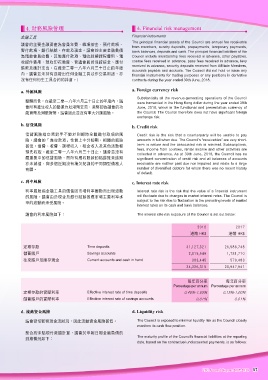

議會的利率風險如下: The interest rate risk exposure of the Council is set out below:

2018 2017

港幣 HK$ 港幣 HK$

定期存款 Time deposits 31,127,321 26,586,748

儲蓄賬戶 Savings accounts 2,815,549 1,781,710

往來賬戶及庫存現金 Current accounts and cash in hand 383,445 579,483

34,326,315 28,947,941

每年百分率 每年百分率

Percentage per annum Percentage per annum

定期存款的實際利率 Effective interest rate of time deposits 0.45%-1.65% 0.15%-1.00%

儲蓄賬戶的實際利率 Effective interest rate of savings accounts 0.01% 0.01%

d. 流動資金風險 d. Liquidity risk

議會密切監察現金流狀況,因此流動資金風險甚低。 The Council is exposed to minimal liquidity risk as the Council closely

monitors its cash flow position.

按合約未貼現付款額計算,議會於申報日期金融負債的

到期情況如下: The maturity profile of the Council’s financial liabilities at the reporting

date, based on the contractual undiscounted payments, is as follows:

57

TIC Annual Report 2017-2018 57