Page 54 - 香港旅遊業議會(2017-2018年度報告)

P. 54

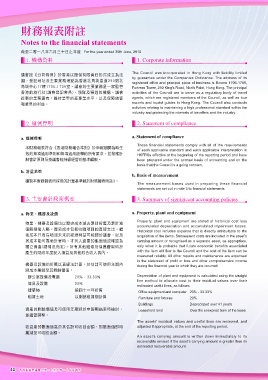

財務報表附註

Notes to the financial statements

截至二零一八年六月三十日止年度 For the year ended 30th June, 2018

. ዚ༟ࣘ 1. Corporate information

The Council was incorporated in Hong Kong with liability limited

議會按《公司條例》於香港以擔保有限責任形式成立為法 by guarantee under the Companies Ordinance. The address of its

團,登記地址及主要業務地點為香港北角英皇道250號北 registered office and principal place of business is Rooms 1706-1709,

角城中心17樓1706-1709室。議會的主要業務是一家監管 Fortress Tower, 250 King’s Road, North Point, Hong Kong. The principal

香港的旅行社(議會登記會員)、領隊及導遊的機構。議會 activities of the Council are to serve as a regulatory body of travel

從事的業務還有:維持業界的高專業水平,以及保障旅客 agents, which are registered members of the Council, as well as tour

和業界的利益。 escorts and tourist guides in Hong Kong. The Council also conducts

activities relating to maintaining a high professional standard within the

industry and protecting the interests of travellers and the industry.

. ፭Էᑊ 2. Statement of compliance

a. 遵例聲明 a. Statement of compliance

These financial statements comply with all of the requirements

本財務報表符合《香港財務報告準則》於申報期開始時生 of each applicable standard and each applicable interpretation in

效的每項適用準則和每項適用詮釋的所有要求,並按應計 HKFRSs effective at the beginning of the reporting period and have

制會計原則及按議會能持續經營的基準編製。 been prepared under the accrual basis of accounting and on the

basis that the Council is a going concern.

b. 計量基準

b. Basis of measurement

編製本財務報表所採用的計量基準載於財務報表附註3。

The measurement bases used in preparing these financial

statements are set out in note 3 to financial statements.

. ˴ࠅึࠇ݁ഄ฿ࠅ 3. Summary of signigicant accounting policies

a. 物業、機器及設備 a. Property, plant and equipment

Property, plant and equipment are stated at historical cost less

物業、機器及設備均以歷史成本減去累計折舊及累計減 accumulated depreciation and accumulated impairment losses.

值虧損後入賬。歷史成本包括收購項目的直接支出。繼 Historical cost includes expense that is directly attributable to the

後成本只有在項目未來的經濟利益可能歸於議會,以及 acquisition of the items. Subsequent costs are included in the asset’s

其成本能可靠地計量時,才列入資產的賬面值或確認為 carrying amount or recognised as a separate asset, as appropriate,

獨立資產(視情況而定)。所有其他維修及保養費用均於 only when it is probable that future economic benefits associated

產生的財政年度記入損益及其他綜合收入表內。 with the item will flow to the Council and the cost of the item can be

measured reliably. All other repairs and maintenance are expensed

in the statement of profit or loss and other comprehensive income

機器及設備的折舊以直線法計算,於估計可使用年期內 during the financial year in which they are incurred.

將成本攤銷至其剩餘價值:

辦公室設備及電腦 20% - 33.33% Depreciation of plant and equipment is calculated using the straight

line method to allocate cost to their residual values over their

傢具及設備 20%

estimated useful lives, as follows:

建築物 按四十一年折舊 Office equipment and computer 20% - 33.33%

租賃土地 以剩餘租賃期計算 Furniture and fixtures 20%

Buildings Depreciated over 41 years

資產的剩餘價值及可使用年期將於申報期結束時檢討, Leasehold land Over the unexpired term of the lease

並適當調整。

The assets’ residual values and useful lives are reviewed, and

若資產的賬面值高於其估計可收回金額,則賬面值即時 adjusted if appropriate, at the end of the reporting period.

撇減至可收回金額。

An asset’s carrying amount is written down immediately to its

recoverable amount if the asset’s carrying amount is greater than its

estimated recoverable amount.

52

52 香港旅遊業議會二零一七至二零一八年度報告