Page 8 - 德望學校(家長教師會22期)

P. 8

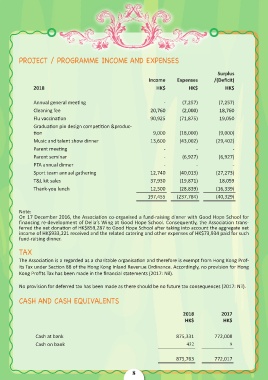

PROJECT / PROGRAMME INCOME AND EXPENSES

Surplus

Income Expenses /(Defi cit)

2018 HK$ HK$ HK$

Annual general meeti ng - (7,257) (7,257)

Cleaning fee 20,760 (2,000) 18,760

Flu vaccinati on 90,925 (71,875) 19,050

Graduati on pin design competi ti on &produc-

ti on 9,000 (18,000) (9,000)

Music and talent show dinner 13,600 (43,002) (29,402)

Parent meeti ng - - -

Parent seminar - (6,927) (6,927)

PTA annual dinner - - -

Sport team annual gathering 12,740 (40,013) (27,273)

T&L kit sales 37,930 (19,871) 18,059

Thank-you lunch 12,500 (28,839) (16,339)

197,455 (237,784) (40,329)

Note:

On 17 December 2016, the Associati on co-organised a fund-raising dinner with Good Hope School for

financing re-development of Delia’s Wing at Good Hope School. Consequently, the Association trans-

ferred the net donati on of HK$859,287 to Good Hope School aft er taking into account the aggregate net

income of HK$933,221 received and the related catering and other expenses of HK$73,934 paid for such

fund-raising dinner.

TAX

The Associati on is a regarded as a charitable organisati on and therefore is exempt from Hong Kong Prof-

its Tax under Secti on 88 of the Hong Kong Inland Revenue Ordinance. Accordingly, no provision for Hong

Kong Profi ts Tax has been made in the fi nancial statements (2017: Nil).

No provision for deferred tax has been made as there should be no future tax consequences (2017: Nil).

CASH AND CASH EQUIVALENTS

2018 2017

HK$ HK$

Cash at bank 875,331 772,008

Cash on bank 432 9

875,763 772,017

8